Magento Fixed Product Taxes Tutorial

How to set up fixed product taxes in Magento

If you need to add fixed taxes to some of your products, Magento has options that you can use to enable and configure fixed taxes. As you know whereas VAT, sales taxes, etc. are added to product prices as a percentage of those prices, a fixed tax is added to the product price as a fixed sum of money. VAT, sales taxes and other taxes that are calculated as a percentage of the price are configured and added in Magento using tax rates and tax rules. For more information on this you can read the general tutorial on setting up and configuring tax rates and rules in Magento.

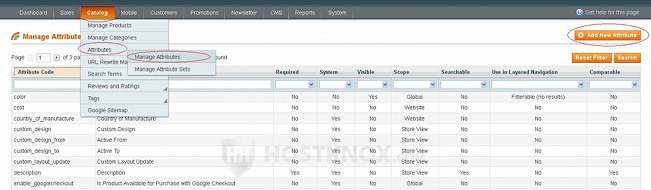

Fixed taxes are added in Magento with the help of attributes. So you have to add an attribute that will be used to configure the fixed tax when you add/edit products. To do this in your Magento admin panel go to Catalog menu>Attributes>Manage Attributes. On the page that opens click on the Add New Attribute button:

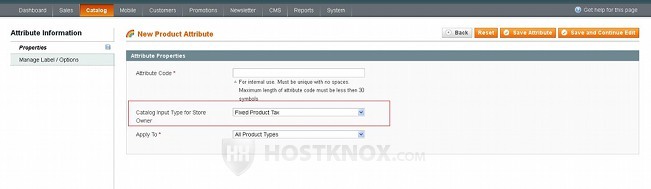

On the page with the attribute settings select Fixed Product Tax from the drop-down menu Catalog Input Type for Store Owner. When you do that most of the other settings will automatically disappear:

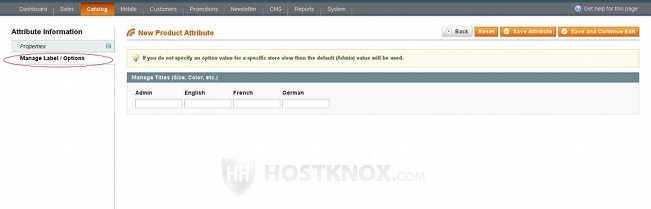

Type a code for the attribute in the field for Attribute Code (it's for internal use) and click on the Manage Label/Options button on the left to specify the labels (the name of the tax) as they will appear on the frontend. You can type a label for each store view that you've added:

When you're done with the settings don't forget to click on the Save Attribute button.

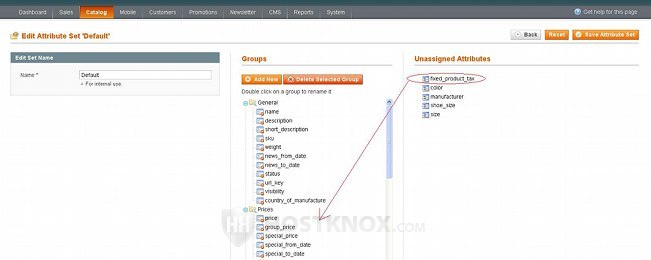

Once you have the attribute you need to add it to an attribute set. Of course, if you need to, you can add it to many attribute sets. To do this go to Catalog menu>Attributes>Manage Attribute Sets. On the page that opens click on the attribute set to which you want to add the attribute for the fixed tax (or you can add a new set if you want to). Then on the page with the attributes in the attribute set drag and drop the attribute for the fixed tax from the right column into the section on the left in which you want the option to appear on the add/edit products form:

The other tax option is in the Prices section by default so it makes sense to put the attribute for fixed product tax there too, but you can place it wherever you want. After that click on the Save Attribute Set button. In case you need more details on adding attributes and attribute sets check out the tutorial on adding attributes in Magento and the one on adding and managing attribute sets in Magento.

For those products that you have already added using the attribute set(s) to which you added the attribute for fixed tax the option will be included in the section in which you put it. So if you want to add fixed taxes to those products you just have to edit them. When you add new products and you want them to have a fixed tax select an attribute set to which you've added an attribute for fixed tax.

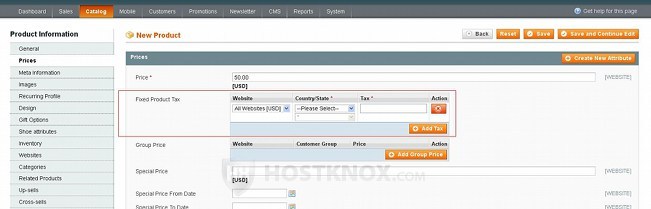

Assuming that you put the fixed tax attribute in the Prices section, when you add/edit a product click on the Prices button on the left, find the option for fixed tax on the right, click on the Add Tax button, type the tax amount in the Tax field and select the country and state/province to which you want the tax to apply:

You can specify different taxes for different countries/states. If a particular country and state match the address of the customer, the tax will be applied.

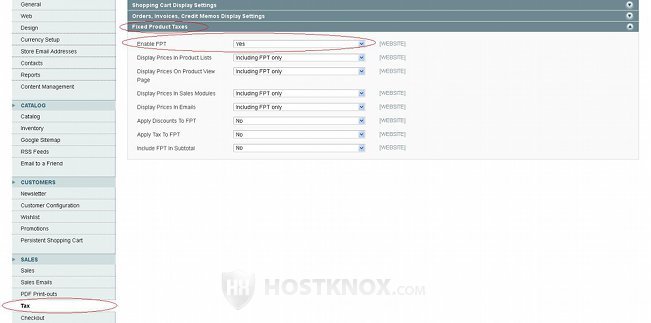

By default, fixed product taxes are disable so in addition to all the above things you also need to enable fixed product taxes. To do this go to System menu>Configuration>Tax button in the Sales section on the left>Fixed Product Taxes panel on the right. Then set the Enable FPT drop-down menu to Yes:

Don't forget to click on the Save Config button. From the other settings in the Fixed Product Taxes panel you can manage various things related to fixed product taxes (e.g. display settings, interaction with other taxes and discounts). For more information on these settings check out the Fixed Product Taxes section of the Magento tutorial on managing the system tax settings.