Magento Tax Rate Export/Import Tutorial

How to export and import tax rates in Magento

Magento has a built-in feature which you can use to export and import tax rates. This is useful if you have many tax rates and you want to update them more quickly, or if you want to export tax rates from one installation and import them in another.

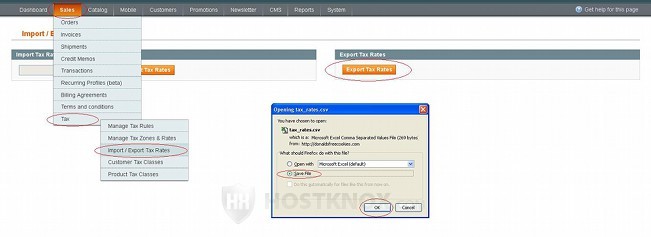

To export tax rates, log in to the admin panel of your Magento and go to Sales menu>Tax>Import/Export Tax Rates. On the page that opens click on the Export Tax Rates button. Then use the window that pops out to save the file with the tax rates on your local computer:

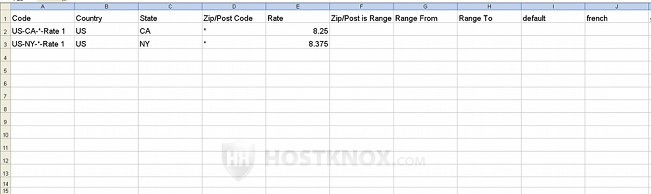

The tax rates are saved in a CSV file (comma-separated values file). In case you want to update your tax rates before importing them into the same or into another shop, you can edit the CSV file with an application such as Microsoft Excel or OpenOffice Spreadsheet (or you can use a text editor such as WordPad, or Notepad). You'll probably find it easier to use Microsoft Excel or OpenOffice Spreadsheet. When you open the file you'll see that the first row is labeled with the options of the tax rates (e.g. code, country, state, zip/post code, etc.). In the column under each label you'll see the values for that option for each of the tax rates:

So you can change anything from the code (name), country, state, percent rate of the tax rate to its titles in the different store views. The store views might be different if you import the file into a different store with different store views than the one from which you exported the tax rates.

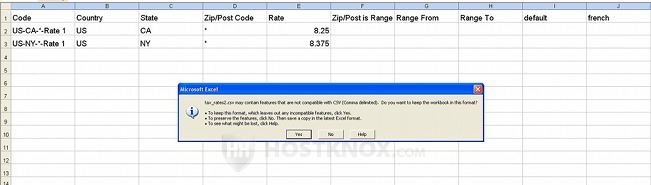

When you use Microsoft Excel or OpenOffice to edit the file and you proceed to save the changes you'll be asked whether you want to keep the format of the file:

Keep the original format by clicking on the Yes button.

To import tax rates into your Magento store, in the admin panel go to Sales menu>Tax>Import/Export Tax Rates. On the page that opens click on the Browse button to locate the CSV file on your local computer and then click on the Import Tax Rates button:

Those tax rates that have matching tax identifiers (labeled as Code in the CSV file) will be overwritten/update with the option values from the CSV file, the others will be added as new tax rates. Unlike importing products it's less likely for any errors or problems to occur when you import tax rates. Note that only tax rates are imported so if you imported them in a different store, you may also need to reconfigure your tax rules.

For more general information on configuring tax rates and rules check out the Magento tutorial on managing taxes in Magento. You may also find useful the tutorial on the system tax settings in Magento.